Researching buy to let mortgage rates and lender criteria is time-consuming and thats before you even get to completing the application forms. The position requires a minimum of two years of recent mortgage closing and funding experience in mortgage operations environment This job requires a working knowledge of documents and current regulatory requirements for closingfunding all mortgage lending products as it relates to HMDA RESPA REG Z AML PRIVACY ACT LI-HJ1.

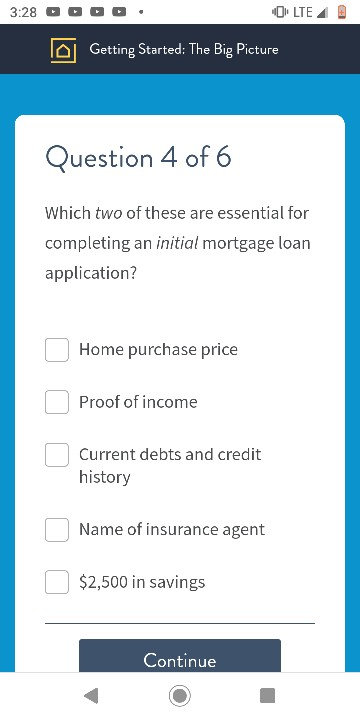

Solved 3 28 Olte Getting Started The Big Picture Question 4 Chegg Com

We would like to show you a description here but the site wont allow us.

. To help the new Notaries in our community here are 5 steps to a proper notarization. There are 3 steps to get mortgage agent licensed in Ontario. If enrolling in single subjects with the.

Norwich Norfolk with over 25 years of comprehensive financial advice experience. Your time is valuable. Having resilience and a strong team will help you succeed.

Almost every state requires the signer to personally appear before you during the notarization. Dont know who the future homeowner will be. If you are new to the site and would like to obtain a USDA Service Center Customer ID and password please Register now.

Thats crucial because it helps protect your signer your employer anyone relying on the notarization and you against potential fraud and. California Probate Code 17200 Petition Sample. Mortgage brokers should focus on what they do best.

If you can survive the first year mortgage broking can be a rewarding way to earn a great income. Therefore the HLLQP and the licensing exams can be completed in as little as 3-4 weeks from initial registration. To maintain and extend your knowledge and skills is essential to remaining compliant under ASICs Regulatory Guide 206 RG 206.

My state ND doesnt require that a journal be kept. Independent Mortgage Broker and Independent Financial Advisor services. Your most recent personal and if applicable business tax returns.

Its essential to be prepared with the required documents and information before completing the application. They increase protein within cells especially in skeletal muscles and also have varying degrees of virilizing effects including. Own the lot already.

FNS50320 Diploma of Finance and Mortgage Broking Management Upgrade Gap ModuleRPL. Pass The Course - the mortgage agent course can be done in as little as 5 days for as little as 338. To create a RACI chart list all of a projects tasks down the left-hand column and stakeholders across the top row.

Bank statements for all accounts. Anabolic steroids also known more properly as anabolicandrogenic steroids AAS are steroidal androgens that include natural androgens like testosterone as well as synthetic androgens that are structurally related and have similar effects to testosterone. He is a member of the California Association of Realtors Legal Affairs Forum and is an Advisor with the California State Bars Executive Committee for the Real Property Law Section 262019.

1 during the two-year period preceding the date on which it was appointed receiver. Authorizes the FDIC as receiver of a covered financial company to recover from any current or former senior executive or director substantially responsible for the companys failed condition any compensation received. The Financial Services Regulatory Authority sets the requirements in order to become licensed after completing the HLLQP course.

Thanks once again and looking forward to completing this transaction. However in case any notarization is every called into question I keep one. Get Hired - you must join a mortgage brokerage first before you can get licensed.

Or 2 at any time in the case of fraud. The two options here are if the builder will finance or if the buyer will finance. However to protect everyones privacy I keep a loose page journal so that if ever proof of notarization and verification of ID is required only the information about the specific persons or specific notarization for repeat customers is.

Outsourced Mortgage Broker Support. Dont forget to factor in size too as square footage can have a major impact on home value. Seeing customers and writing deals.

To help you plan your trip to Canada weve compiled a list of essential items that we recommend you arrange prior to your departure as well as a list of things to. The Service Center Agencies SCA include Farm Service Agency Natural Resources Conservation Service and Rural DevelopmentFor your convenience we have provided several services online. Complete the FSRA Application - the FSRA formerly FSCO licensed mortgage brokerage applies to FSRA for your mortgage agent.

26 weeks to complete the learning and assessment requirements for the FNS40821 Certificate IV in Finance and Mortgage Broking from their initial activation date. Discover how outsourced mortgage broker support can help. FHA Mortgage Calculator allows you to see total mortgage costs including your FHA MIP charges over any time frame.

While you made the initial first step on your own it is important to remember that Moving2Canada is here to assist you with making the move to Canada as smooth as possible. 7- and 10- year fixed-rate periods. The job board is essential in choosing a brokerage.

If youd like the builder to fund the construction then a subject to appraisal will be performed at the time of the initial underwriting. 1 to Determine Ownership of Real Property Pursuant. W-2s for at least the past two years.

FNS50320 Diploma of Finance and Mortgage Broking Management Upgrade. So save yourself time and let us do the hard work. Usually when the builder is the borrower they.

1543 16 Aug 22. Petition - TrustPursuant Prob Code Sec 17200 Initial - Petition. Recent pay stubs or verification of employment.

We asked for David Weeds help on Sowerbys recommendation after two mortgage brokers had failed to find us a. A four-bed two-bath house may seem like a pretty close comp for a three-bed two-bath house but thats not necessarily true. With completion of FNS40820 or FNS40821 Certificate IV in Finance and Mortgage Broking receive credit transfer for Subject 1 of the Diploma.

In each of the ARM options the interest rate remains fixed for the initial loan period say five or seven or ten years then adjusts every year for the remainder of the 20-year loan period. For our expert brokers knowing which lender and mortgage products are the most suitable for you is quite literally the day job. New Reverification Options Harness Automation to Support a Seamless Customer ExperienceATLANTA Aug.

24 2022 PRNewswire -- Today Equifax NYS. For each task enter an R A C or I to assign a level of involvement for. That extra bedroom can often mean a price difference of 100000 or more.

Understanding Mortgage Offers Moneysupermarket

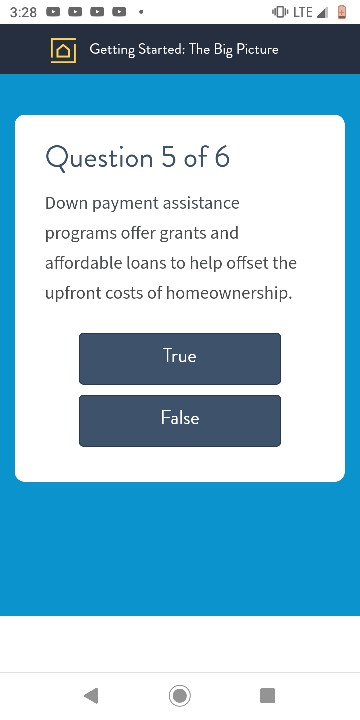

Which Two Are Essential For Completing An Initial Mortgage

Which Two Are Essential For Completing An Initial Mortgage

Which Two Of These Are Essential For Completing An Initial Mortgage Loan Application Home Purchase Brainly Com

Solved 3 28 Olte Getting Started The Big Picture Question 4 Chegg Com

Which Two Are Essential For Completing An Initial Mortgage

0 comments

Post a Comment